AI Agent Platform Selection: IDC 2025 Guide

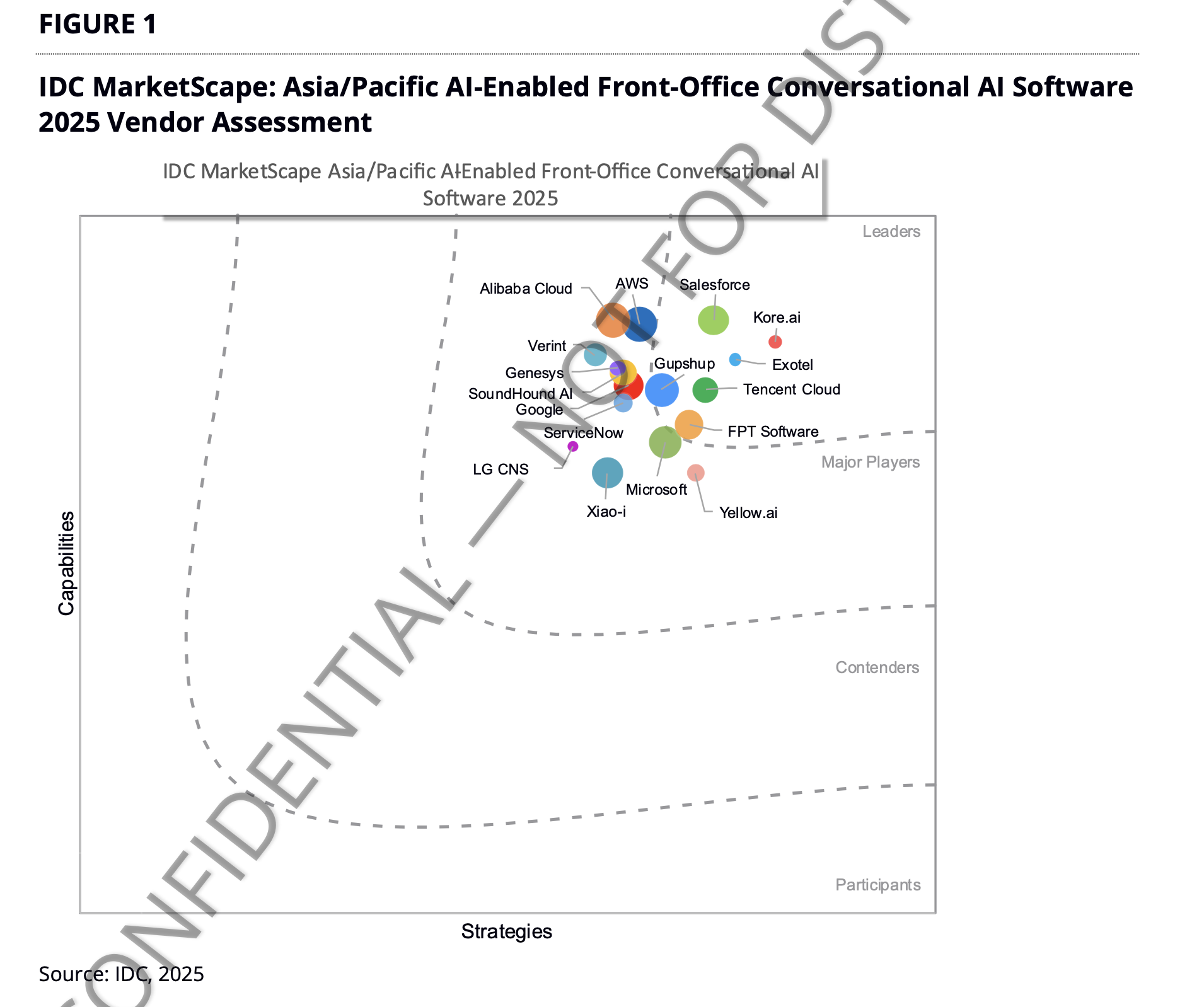

IDC MarketScape Asia/Pacific Front-Office Conversational AI Vendor Positioning (Source: IDC, November 2025)

Report Overview

In November 2025, IDC released the Asia/Pacific AI-Enabled Front-Office Conversational AI Software Vendor Assessment—the first IDC evaluation in this category to establish regional qualification thresholds:

| Qualification Criteria | Threshold |

|---|---|

| Regional Revenue | Exceeding $3 million in Asia/Pacific |

| Customer Retention | Continuous use for over 1 year |

| Production Deployment | Enterprise production environments in at least 3 markets |

These criteria effectively filter out vendors with insufficient regional commitment or unproven production readiness. IDC positioned Tencent Cloud ADP as a Leader, recognizing its combination of agentic AI capabilities and regional deployment flexibility.

This article covers:

- Unique vendor selection challenges in Southeast Asia

- How to apply the IDC evaluation framework

- Vendor selection recommendations based on the report

Vendor Selection Challenges in Southeast Asia

IDC research indicates that only 56% of Asia/Pacific enterprises have deployed even limited GenAI applications (Source: 2025 Future Enterprise Resiliency and Spending Survey, APJ n=300). In the Agentic AI space, most enterprises remain in the proof-of-concept stage.

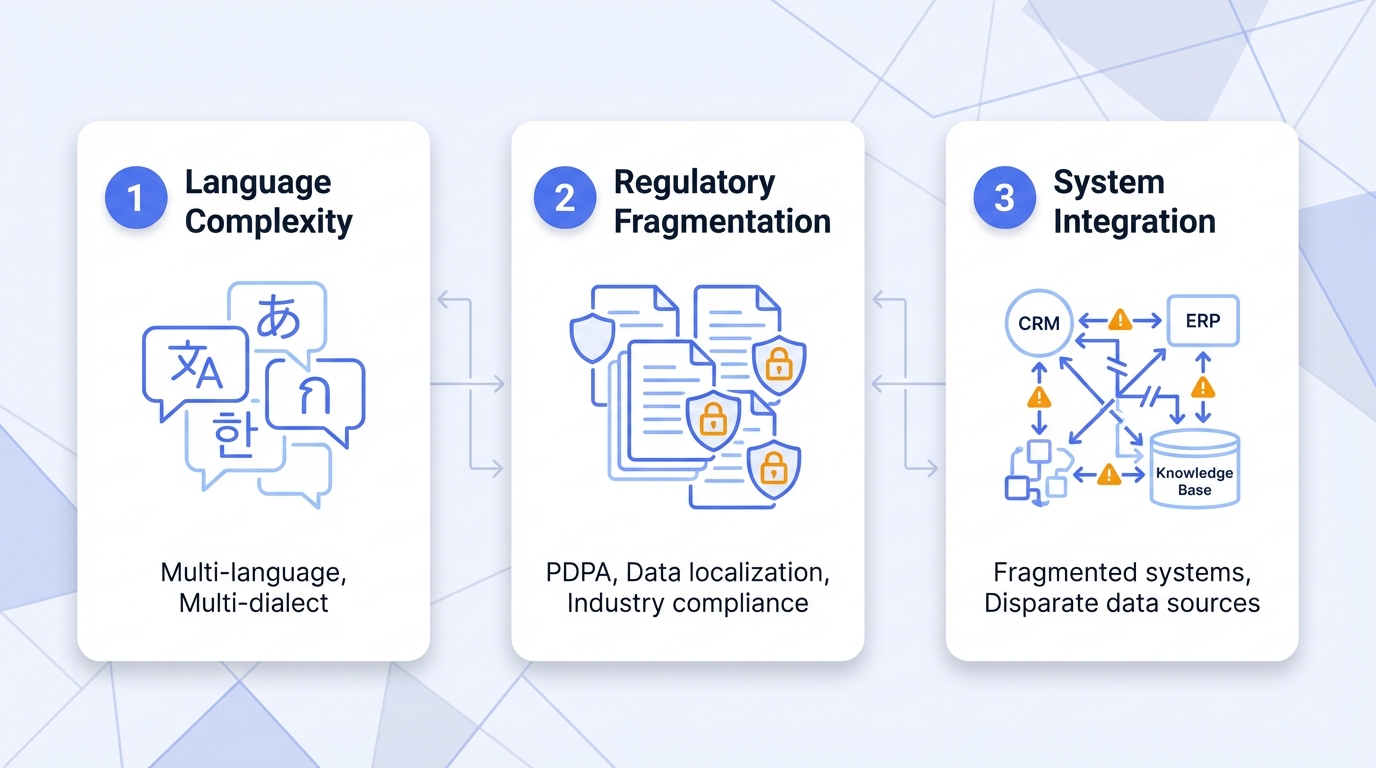

Southeast Asia presents three challenges that distinguish it from other regions:

Language and Localization Complexity

Southeast Asia spans 40+ countries with thousands of languages and dialects. Enterprise challenges extend beyond translation:

| Dimension | Specific Challenge |

|---|---|

| Industry Terminology | Professional expressions in finance, healthcare, and legal sectors vary by country |

| Cultural Context | Customer communication styles differ significantly across cultures, affecting intent recognition accuracy |

| Regional Variants | The same language exhibits vocabulary and grammatical differences across countries |

The IDC report notes: vendors must provide "not only strong AI capabilities but also localized support, regulatory alignment, and the ability to integrate into real business workflows."

Regulatory Fragmentation

Data compliance requirements vary significantly across markets:

| Market | Primary Compliance Requirements | Deployment Impact |

|---|---|---|

| Singapore | PDPA + cross-border data transfer rules | Must clarify data flow and storage locations |

| Indonesia | Mandatory data localization for specific sectors | Some scenarios require local deployment |

| Thailand | PDPA + financial sector addendums | Financial institutions need private deployment options |

| Malaysia | PDPA + regulated industry overlays | Must assess industry-specific requirements |

For financial services, telecom, and public sector organizations, these regulations often preclude single public cloud deployment, requiring private, hybrid, or multi-cloud options.

Enterprise System Integration Complexity

IDC observes that enterprises commonly face "fragmented internal systems and disparate data sources." AI Agents must connect to CRM, ticketing systems, knowledge bases, and other data sources to deliver effective service—placing significant demands on platform integration capabilities.

Understanding the IDC Evaluation Framework

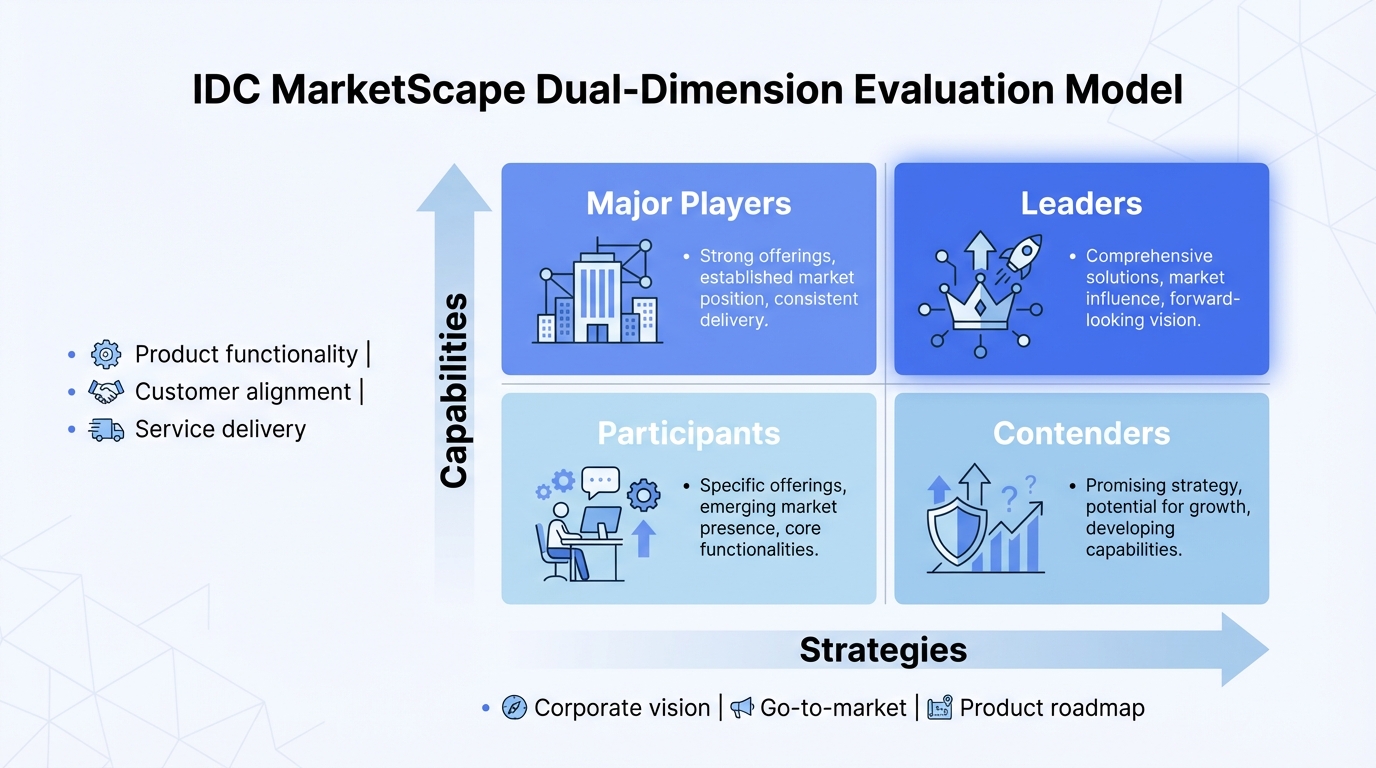

IDC MarketScape employs a dual-dimension evaluation model:

| Dimension | Evaluation Scope | Enterprise Focus |

|---|---|---|

| Capabilities (Y-axis) | Current product functionality, customer needs alignment, service delivery effectiveness | Ability to solve current problems |

| Strategies (X-axis) | Corporate vision, go-to-market approach, product roadmap | Ability to support medium-to-long-term requirements |

Quadrant Positioning Explained

| Category | Characteristics | Selection Guidance |

|---|---|---|

| Leaders | Strong performance in both current capabilities and future strategies | Suitable for scenarios requiring robust platform capabilities and continuous evolution |

| Major Players | Solid overall performance with specific competitive advantages | Evaluate alignment between their strengths and your requirements |

| Contenders | Emerging vendors building market presence | Suitable for organizations willing to accept some risk for differentiated capabilities |

| Participants | Focused on niche segments or in early stages | Suitable for deep vertical-specific requirements |

Tencent Cloud ADP: IDC Leader Positioning

IDC positioned Tencent Cloud in the Leaders category. The following summarizes key assessment points from the report.

Agentic AI Platform Capabilities

IDC highlighted Tencent Cloud's Agent Development Platform (ADP), launched globally in 2025:

"Using ADP, Tencent can elevate FOC AI solutions to mission-critical, automated systems capable of directly executing complex tasks and deeply integrating them into core service operations."

— IDC MarketScape Report, November 2025

Core platform capabilities include:

| Capability Module | Description |

|---|---|

| RAG Pipeline | Enterprise knowledge base integration with retrieval-augmented generation for private data |

| Workflow Orchestration | Visual configuration of complex business processes, reducing development barriers |

| Multi-Agent Architecture | Multiple agents collaborating to handle complex task scenarios |

See these capabilities in action: Build a Customer Service AI Agent in 6 Steps

Regional Coverage and Deployment Flexibility

| Dimension | IDC-Reported Data |

|---|---|

| Market Coverage | Singapore, Malaysia, Indonesia, Thailand, Hong Kong |

| Partner Ecosystem | 100+ implementation/consulting partners, 300+ channel partners |

| Enterprise Customer Base | 1,500+ organizations using FOC AI solutions |

| Deployment Models | On-premises, private cloud, hybrid, SaaS |

IDC specifically notes that this localized infrastructure enables Tencent Cloud to address regional languages, cultural norms, and country-specific regulations.

Customer-Centric Approach

"Tencent Cloud's strategy has been to focus on customer needs and deliver tailored solutions with robust end-to-end support, empowering its clients to maximize the impact of their solutions."

— IDC MarketScape Report, November 2025

Areas for Development

IDC also identifies growth opportunities for Tencent Cloud:

- Expanding domain-specific LLMs to reduce training and deployment cycles for vertical scenarios

- Continued regional expansion through marketing and partner development

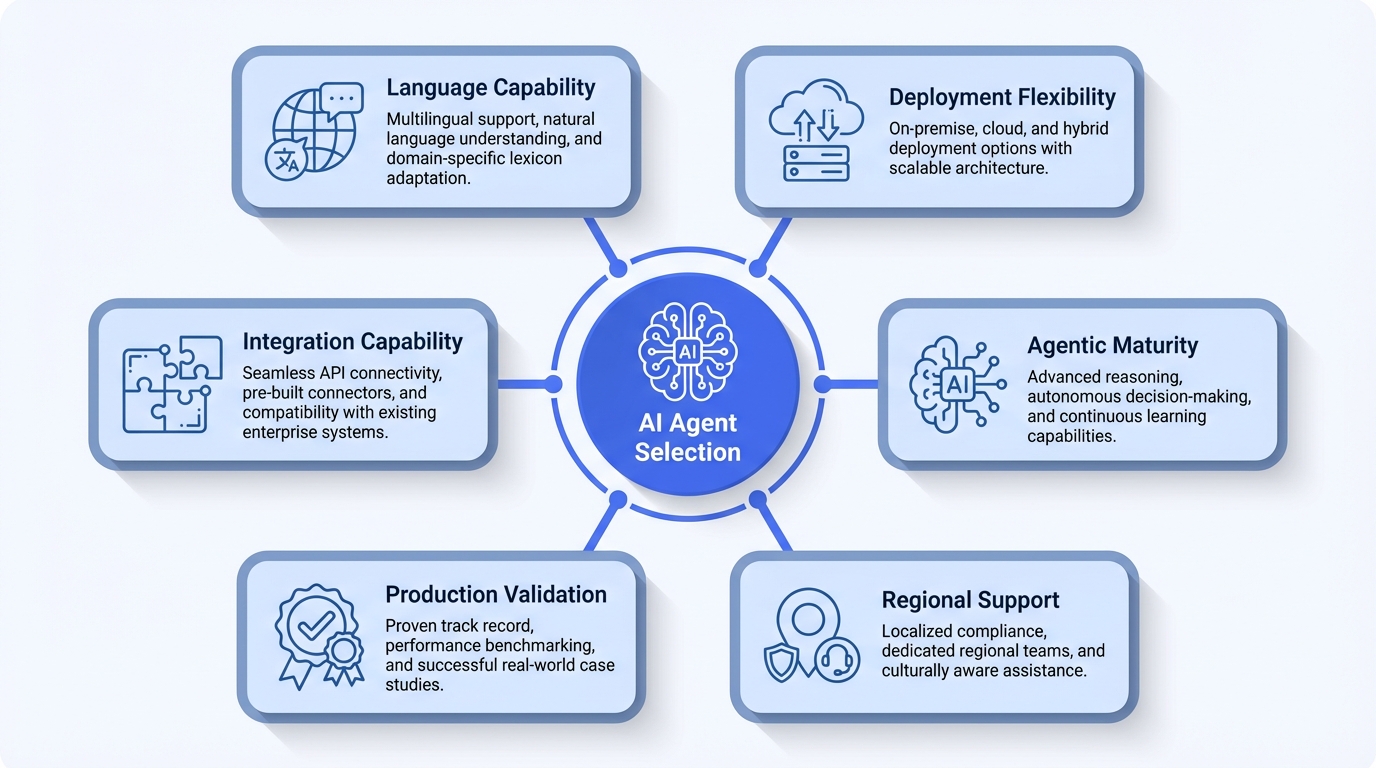

Vendor Selection Methodology

Based on the IDC evaluation framework, enterprises should assess vendors across six dimensions:

Core Evaluation Dimensions

| Dimension | Evaluation Criteria | Verification Method |

|---|---|---|

| Language Capability | Support for target market languages, dialects, and industry terminology | Test with actual business language samples |

| Deployment Flexibility | Availability of private deployment, hybrid cloud options | Confirm deployment architecture alignment with compliance requirements |

| Agentic Maturity | RAG, workflow orchestration, and multi-agent capabilities | Assess platform capability boundaries; distinguish chatbots from agents |

| Regional Support | Local teams in target markets | Understand implementation and operations support response mechanisms |

| Production Validation | Number of production customers and operational duration in the region | Request same-industry reference cases |

| Integration Capability | Ability to connect existing enterprise systems and knowledge bases | Verify connectivity with CRM, ticketing systems, etc. |

Common Selection Mistakes

Mistake 1: Prioritizing global brand recognition

Global market position does not equal regional capability. IDC's qualification criteria explicitly require Asia/Pacific revenue and production customer data. Focus on the vendor's actual investment in your target markets.

Mistake 2: Underestimating language localization requirements

Basic multilingual support differs significantly from deep localization. Verify dialect coverage, industry terminology handling, and cultural context comprehension.

Mistake 3: Evaluating features before deployment constraints

For regulated industries, deployment flexibility may be more critical than feature richness. Confirm that deployment options meet compliance requirements before evaluating AI capabilities.

Market Trends

IDC's evaluation criteria reflect three key shifts in the front-office conversational AI market:

| Dimension | Past | Present |

|---|---|---|

| Product Form | Script-based chatbots | AI Agents with RAG, workflow, and multi-agent capabilities |

| Market Strategy | Global unified solutions | Deep regional localization |

| Deployment Model | Standalone SaaS | Deep integration with enterprise systems |

For enterprises evaluating conversational AI investments in Southeast Asia, IDC MarketScape provides a third-party evaluation framework that accounts for the region's unique complexity.

Get Started

→ Learn about Tencent Cloud ADP

Frequently Asked Questions

What is Front-Office Conversational AI (FOC AI)?

Front-Office Conversational AI refers to AI technologies that enable humanlike interactions between businesses and customers, including chatbots, virtual assistants, voice AI, and intelligent agents. "Front-office" denotes customer-facing application scenarios, distinguishing them from back-office automation.

How does Agentic AI differ from traditional chatbots?

Traditional chatbots operate on predefined scripts or simple intent matching. Agentic AI systems can autonomously retrieve enterprise knowledge through RAG, orchestrate multi-step workflows, support multi-agent collaboration, and integrate with backend systems to execute tasks—handling complex interaction scenarios that traditional chatbots cannot manage.

For a complete guide on building enterprise AI agents, see How Enterprises Build AI Agents in Production

What does "Leader" positioning mean in IDC MarketScape?

In IDC's methodology, Leaders demonstrate strong performance in both current capabilities and future strategies, indicating that the vendor delivers effective solutions today while maintaining a clear product evolution roadmap.

How should enterprises use analyst reports for vendor selection?

Analyst reports like IDC MarketScape should serve as one input in a comprehensive evaluation process that also includes proof-of-concept testing, reference customer conversations, and alignment assessment with specific business requirements to form a complete vendor selection decision basis.

Home

Home Products

Products Resources

Resources Solutions

Solutions Pricing

Pricing Company

Company Find Us

Find Us