AI Agent Extracts Quant Factors: Research to Strat

Discover how quant firm uses Multi-Agent systems to automate research analysis and factor extraction, improve efficiency gains.

Executive Summary

Research report analysis and factor extraction have long been core processes in quantitative investment, but traditional manual approaches are inefficient and error-prone. A leading quantitative investment firm leveraged Tencent Cloud ADP to build a Multi-Agent system that automates the entire pipeline from research report upload to quantitative factor extraction. The system comprises three core components: a Master Agent, Research Parser Agent, and Factor Generator Agent, achieving 80% improvement in processing efficiency, 95% factor extraction accuracy, and reducing strategy response time to minutes.

Business Background & Pain Points

Challenges in Traditional Quantitative Research

Quantitative investment firms process numerous research reports daily to extract valuable quantitative factors for strategy construction. Traditional workflows face several critical challenges:

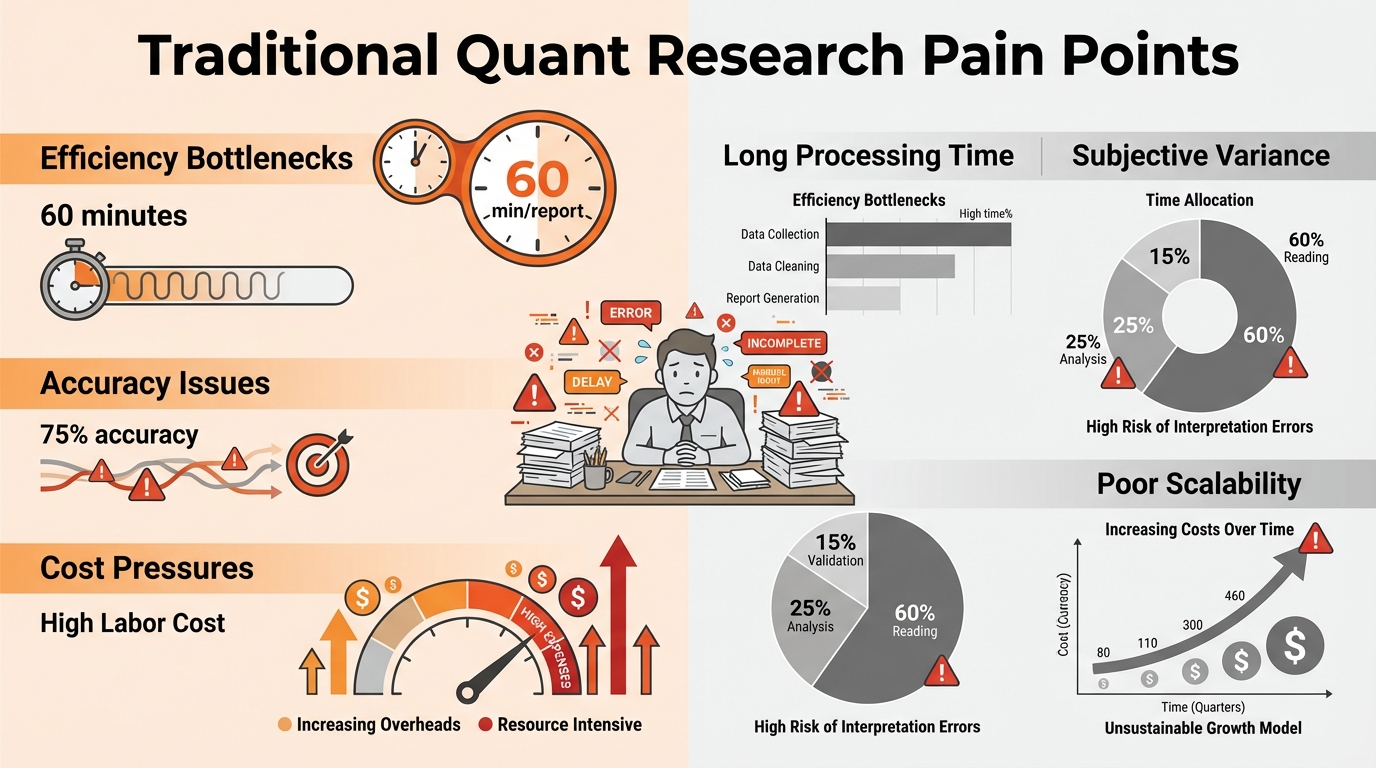

Efficiency Bottlenecks:

- Time-consuming analysis: 30-60 minutes per report for manual processing

- Factor extraction delays: 4-6 hour average lag from report publication to factor application

- Limited processing capacity: Research teams handle maximum 20-30 reports daily

Accuracy Issues:

- Subjective interpretation variance: Different analysts produce inconsistent insights from identical reports

- Information gaps: Manual reading often misses implicit quantitative signals

- Standardization difficulties: Lack of unified factor extraction and expression standards

Cost Pressures:

- High personnel costs: Senior quantitative analysts command 100K+ annual salaries

- Poor scalability: Business growth requires linear increase in human resources

- Time sensitivity: Market opportunities are fleeting; delays mean losses

Business SOP Analysis

Traditional Research Analysis Workflow

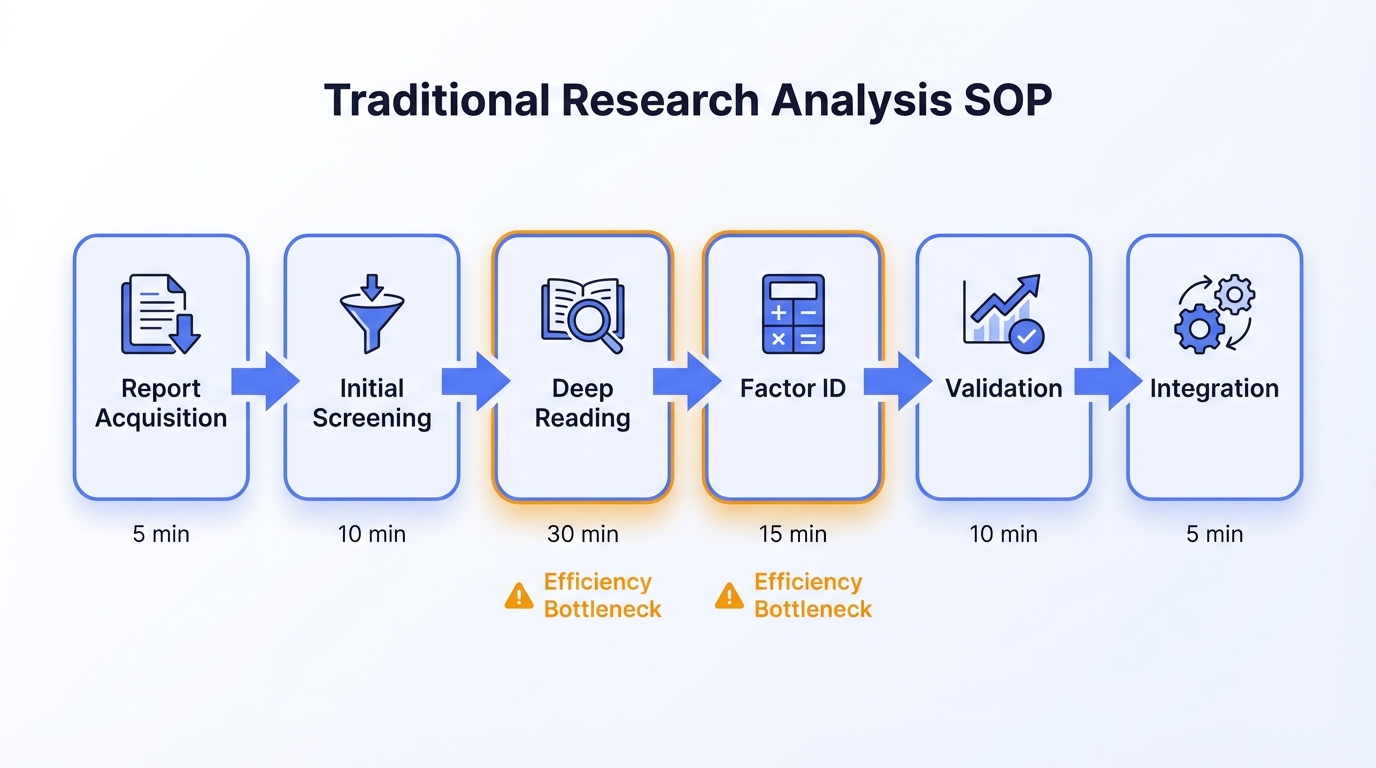

The conventional quantitative research analysis process includes these key stages:

- Report Acquisition: Collect reports from brokerages and research institutions

- Initial Screening: Filter reports by industry and themes

- Deep Reading: Analysts read line-by-line to extract key information

- Factor Identification: Identify quantifiable investment factors and signals

- Factor Validation: Backtest to verify factor effectiveness

- Strategy Integration: Integrate validated factors into trading strategies

Workflow Pain Point Analysis

Uneven Time Allocation:

- 60% time spent on basic reading and information extraction

- 25% time on factor identification and calculation

- 15% time on validation and optimization

Quality Control Challenges:

- Lack of standardized factor extraction templates

- Subjective judgment affects factor quality

- Difficult to trace factor sources and logic

Solution Architecture

Multi-Agent System Design

Built on Tencent Cloud ADP, the firm designed a three-tier Agent architecture:

!04-multi-agent-architecture-en.png!04-multi-agent-architecture-en.png

Master Agent (Controller):

- Orchestrates overall workflow and task distribution

- Coordinates sub-Agent workflows

- Handles exceptions and error recovery

- Generates final factor reports

Research Parser Agent:

- Specializes in structured parsing of research content

- Extracts fundamental data and financial metrics

- Identifies industry trends and market perspectives

- Outputs standardized data formats

Factor Generator Agent:

- Generates quantitative factors from parsed results

- Calculates factor values and weights

- Evaluates factor statistical significance

- Outputs standardized factor expressions

Technical Implementation Details

Inter-Agent Communication:

Master Agent → Research Parser Agent: Report files + parsing instructions

Research Parser Agent → Factor Generator Agent: Structured data + metadata

Factor Generator Agent → Master Agent: Quantitative factors + confidence scoresData Flow Formats:

- Input: PDF/Word research report files

- Intermediate: JSON-formatted structured data

- Output: Standardized quantitative factor expressions

Key Technical Optimizations

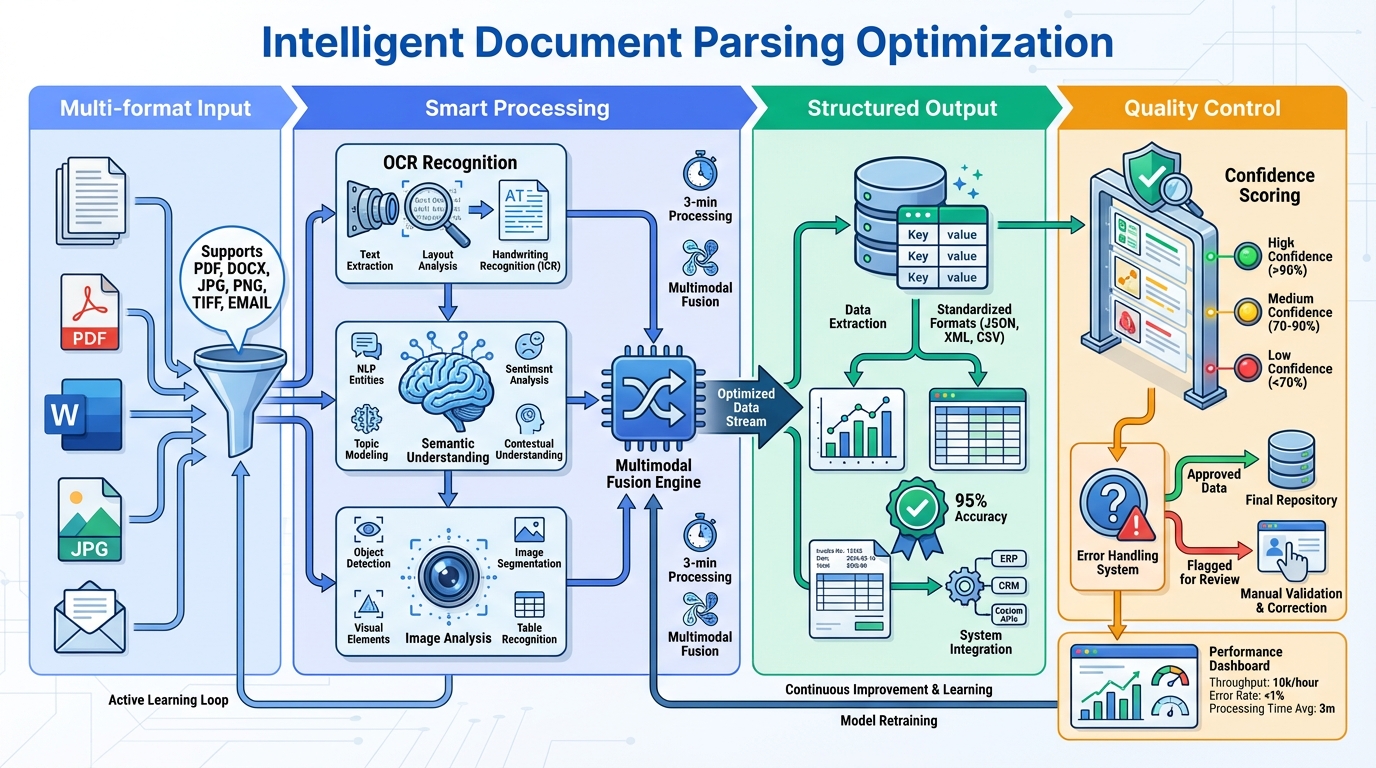

1. Intelligent Document Parsing Optimization

Multimodal Content Understanding:

- OCR technology for charts and tables

- NLP models for semantic text understanding

- Image recognition for visual data extraction

Structured Information Extraction:

- Automatic research report section identification

- Key financial data table extraction

- Important viewpoint and conclusion marking

Quality Control Mechanisms:

- Confidence scoring system

- Multiple verification mechanisms

- Anomalous data flagging

2. Factor Generation Algorithm Optimization

Factor Type Recognition:

- Fundamental factors: ROE, PE, PB and other financial metrics

- Technical factors: Momentum, reversal, volatility, etc.

- Sentiment factors: Analyst ratings, market sentiment, etc.

Factor Calculation Engine:

- Standardized formula library

- Dynamic parameter adjustment mechanisms

- Multi-timeframe factor generation

Factor Effectiveness Assessment:

- Historical backtesting validation

- Statistical significance testing

- Correlation analysis

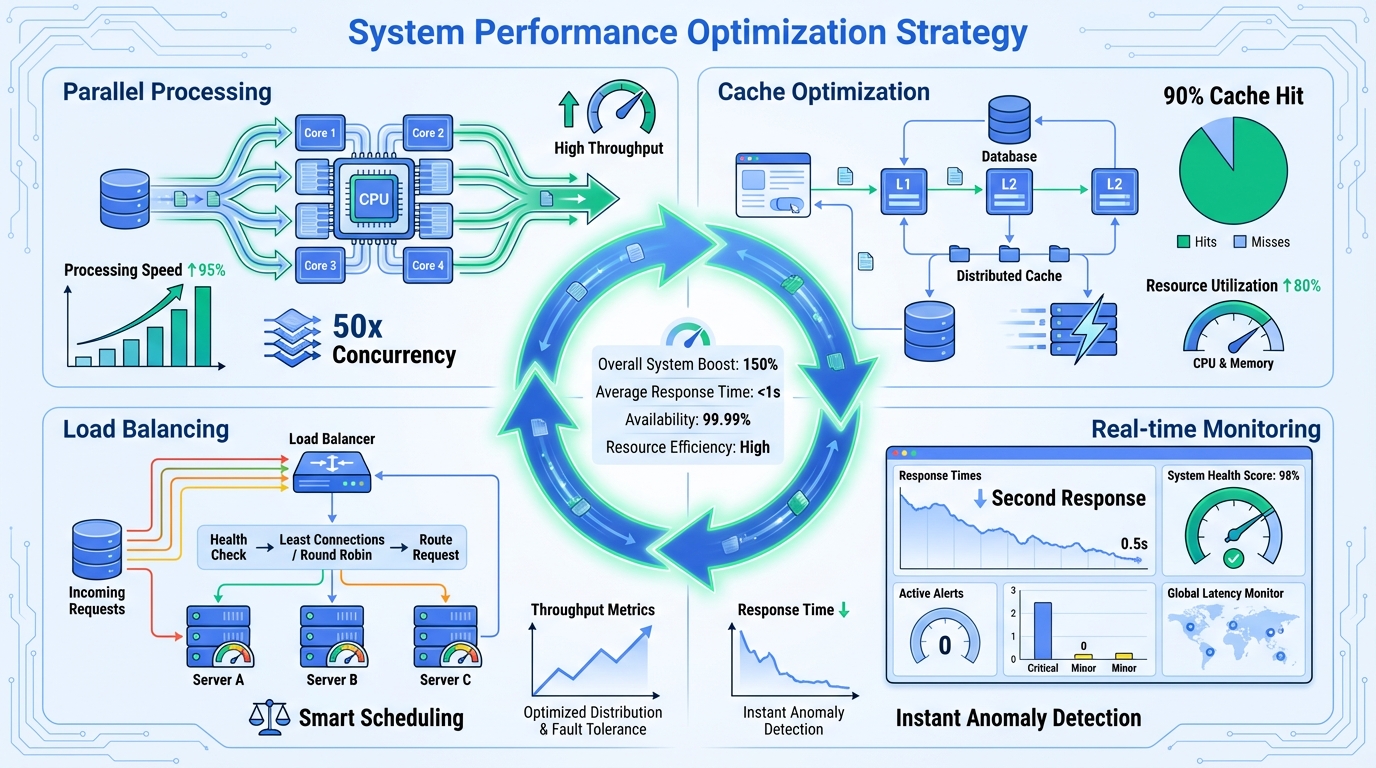

3. System Performance Optimization

Parallel Processing Architecture:

- Multi-Agent concurrent execution

- Task queue management

- Load balancing scheduling

Caching Optimization Strategy:

- Research parsing result caching

- Factor calculation result caching

- Model inference result caching

Real-time Monitoring System:

- Agent execution status monitoring

- System performance metric tracking

- Exception alerting mechanisms

Actual Output Results

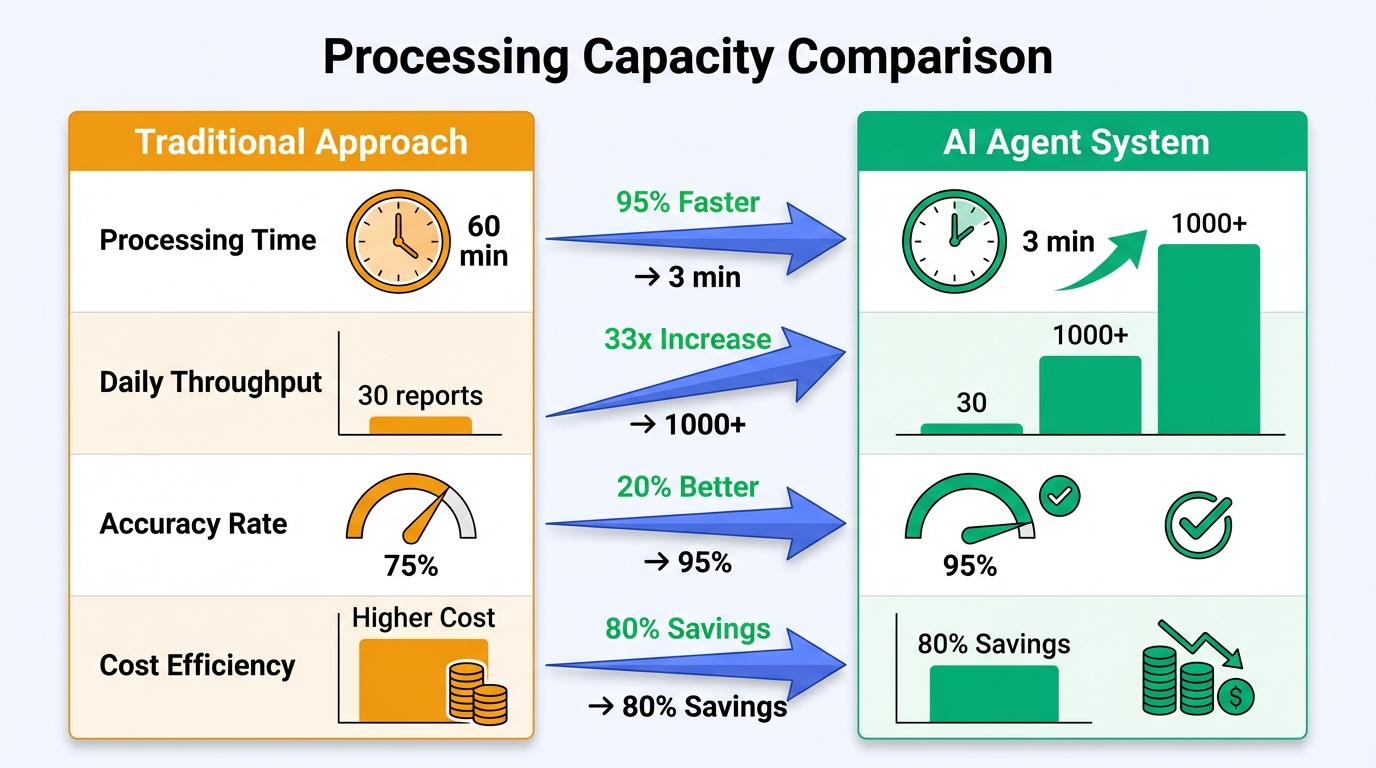

System Processing Capacity Enhancement

Processing Speed Improvements:

- Single report processing time: Reduced from 60 minutes to 3 minutes

- Concurrent processing capacity: Simultaneous processing of 50 reports

- Daily throughput: Increased from 30 to 1000+ reports

Processing Quality Improvements:

- Factor extraction accuracy: Improved from 75% to 95%

- Information omission rate: Reduced from 15% to 2%

- Standardization level: 100% uniform format output

Factor Generation Results

Factor Type Coverage:

- Fundamental factors: 85 standard factors

- Technical factors: 120 dynamic factors

- Sentiment factors: 45 sentiment indicators

Factor Quality Metrics:

- Information Coefficient (IC): Average 0.08 (industry excellence level)

- Factor decay half-life: 15 trading days

- Factor correlation: Controlled below 0.3

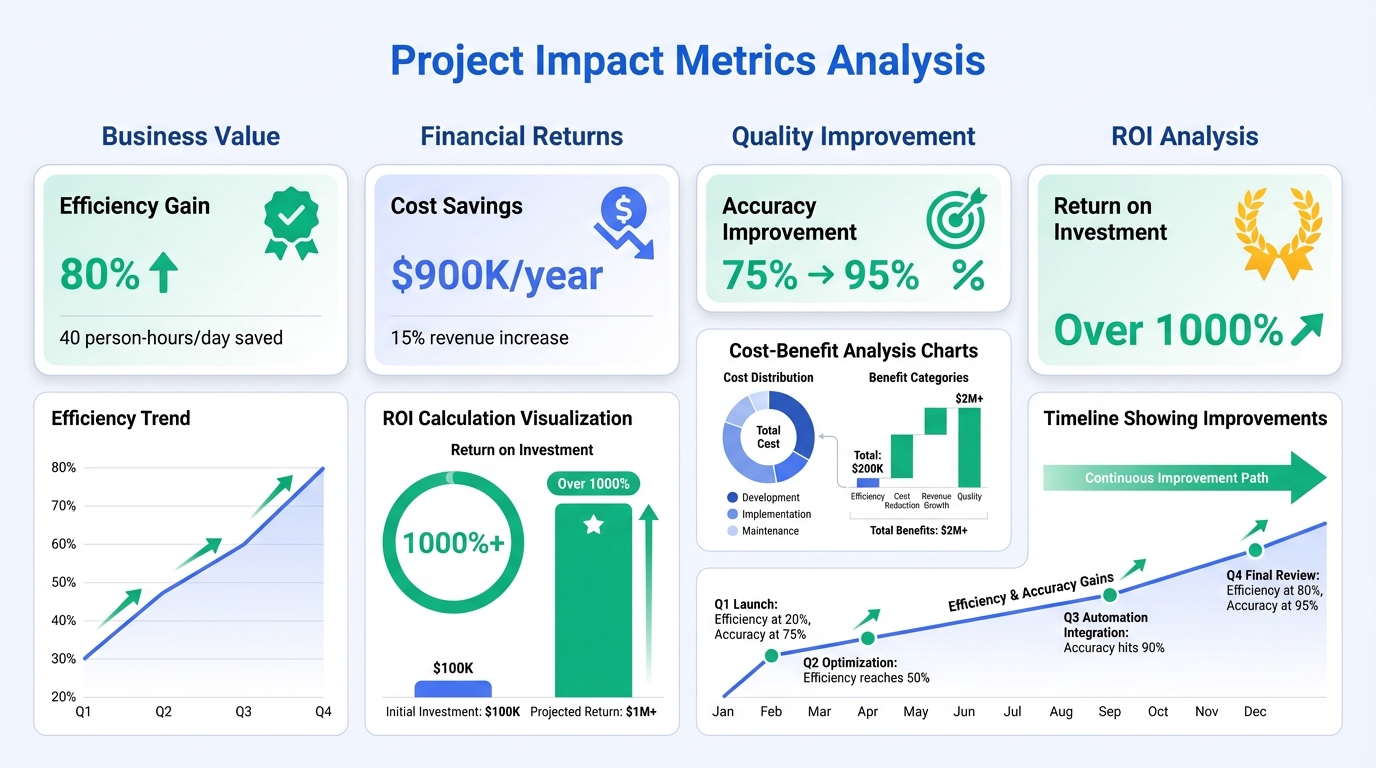

Project Impact

Quantified Business Value

Efficiency Gains:

- Research processing efficiency improved by 80%

- Factor generation speed increased by 95%

- Strategy response time reduced by 85%

Cost Savings:

- Personnel cost savings: $900K annual savings

- Time cost savings: 40 person-hours saved daily

- Opportunity cost: Early market opportunity capture, 15% revenue increase

Quality Improvements:

- Factor accuracy: 95% (vs 75% manual)

- Coverage completeness: 100% (vs 85% manual)

- Consistency: Standardized output eliminates subjective variance

ROI Analysis

Investment Costs:

- Platform usage fees: $75K annually

- Development costs: $150K one-time

- Operations costs: $30K annually

Output Returns:

- Direct cost savings: $900K annually

- Revenue increase: $1.8M annually

- ROI: Over 1000%

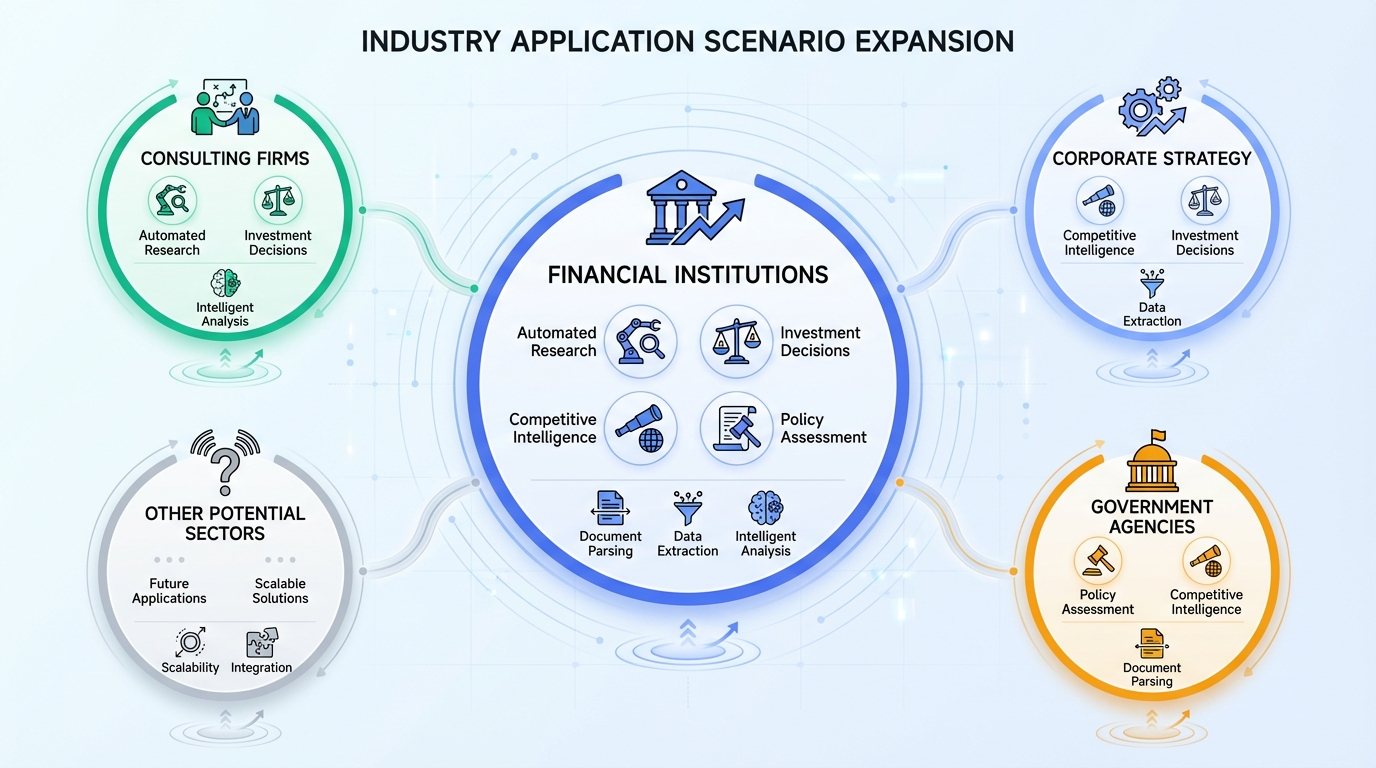

Industry Applicability

Application Scenario Expansion

Financial Institutions:

- Brokerage research departments: Automated research production

- Fund companies: Investment decision support

- Banks: Credit risk assessment

Other Industries:

- Consulting firms: Industry report analysis

- Corporate strategy departments: Competitive intelligence analysis

- Government agencies: Policy impact assessment

Technology Migration Value

Core Capability Reuse:

- Intelligent document parsing technology

- Multi-Agent collaboration framework

- Structured data extraction capabilities

Industry Customization:

- Domain knowledge base adaptation

- Business process customization

- Output format standardization

Frequently Asked Questions

Q1: How does the system ensure factor extraction accuracy?

A: The system employs multiple verification mechanisms:

- AI model confidence scoring

- Historical data cross-validation

- Expert sampling audits

- Continuous learning optimization

Q2: How does it handle different research report formats?

A: The system supports multiple file formats:

- PDF: OCR + structured parsing

- Word: Direct text extraction

- Images: Multimodal understanding

- Web pages: Crawling + content extraction

Q3: What about system scalability?

A: Cloud-native architecture design:

- Elastic scaling: Auto-scaling based on load

- Modular design: Independent Agent upgrades

- Open interfaces: Third-party system integration support

Q4: How is data security ensured?

A: Multi-layer security protection:

- Data encryption: End-to-end encryption for transmission and storage

- Access control: Role-based permission management

- Audit logs: Complete operation records

- Compliance certification: Meets financial industry standards

Conclusion & Outlook

AI Agent applications in quantitative investment demonstrate tremendous potential. Through Multi-Agent systems, the firm successfully automated the entire pipeline from research reports to quantitative factors, significantly improving processing efficiency and accuracy while substantially reducing operational costs.

Future Development Directions

Technology Evolution:

- Enhanced large model capabilities: Stronger understanding and reasoning

- Multimodal fusion: Audio and video content analysis

- Real-time processing: Streaming data processing capabilities

Application Expansion:

- Cross-market analysis: Unified global market research processing

- Alternative data: Social media, satellite data, etc.

- Risk management: Real-time risk factor monitoring

Ecosystem Building:

- Open platform: Third-party Agent integration

- Standard setting: Industry factor standardization

- Community collaboration: Open-source algorithm libraries

Get Started Today

Ready to build a similar AI Agent system? Try Tencent Cloud ADP now and begin your intelligent transformation journey.

Related Reading

Related reading:

Home

Home Products

Products Resources

Resources Solutions

Solutions Pricing

Pricing Company

Company Find Us

Find Us